2022: A Year In Review

Updated: Jan 22, 2023

So it’s been a while. In my last post, I explained that I had several traumatic events within a short time period that caused me to really struggle with my mental health. Given my acute need and the fact that I was living in a rural area, I felt my only option to get quality care was to see my old psychologist who no longer accepted any health insurance. Although my health insurance is pretty good, the out-of-network benefits are effectively nil, meaning I was stuck paying $250 a session for therapy. At once a week, that was about $1,000 a month.

I decided to swallow the pain associated with feeling like I was “throwing away” $1,000 a month I could be investing and get started in therapy. I can assure you it’s been worth it. I’m in a much more stable place and am downright happy. Still, I thought that spending that kind of money on therapy would certainly derail my FIRE goals, but it hasn’t. In fact, I’m doing much better than I ever anticipated.

So, how much was I able to save in 2022?

Well, I didn’t do a perfect job tracking my money. Around the time I started therapy, I fell off the wagon a little with YNAB and decided to “start fresh” in July, so I don’t have the perfect data or the fancy visuals I was hoping for. At worst, I’ve underestimated my savings slightly because I haven’t spent all the money I’ve assigned to my “spend” categories in YNAB.

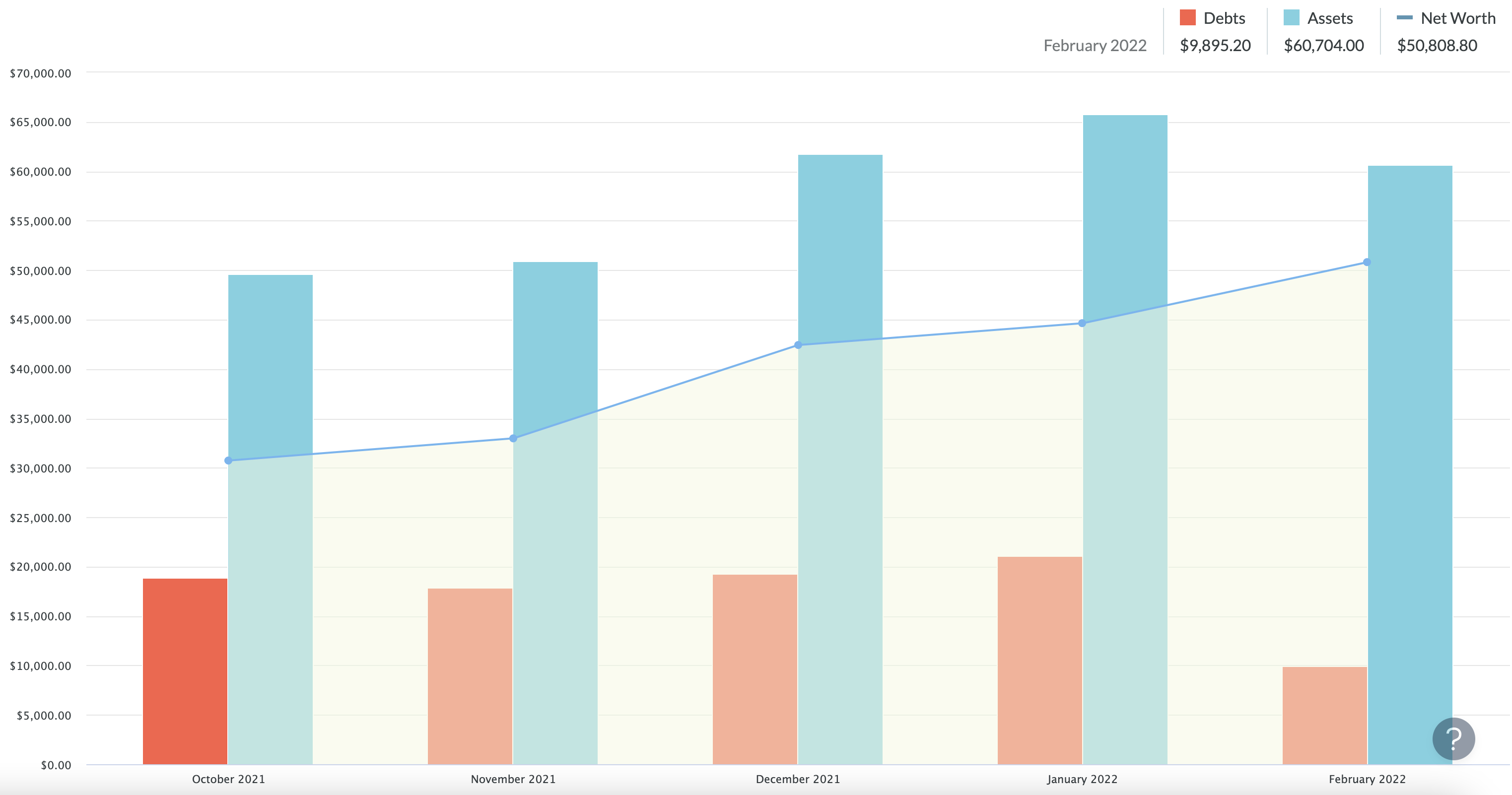

You can find my beginning financial stats here. And below is where I am now.

Total Annual Compensation – $199,736.92

$195,150 total employment compensation (pretax)

$3,234.71 from an insurance payment*

$865.68 credit card rewards

$243.05 HYSA interest

$243.48 from Poshmark sales (let me know if you want a referral code)

*My insurance company misrepresented coverage for my therapy. After they refused to reimburse my sessions, I fought them hard and got them to cover roughly 12 psychotherapy sessions as a result of this misrepresentation. So just a reminder to fight with your insurance company because you really can win and save yourself a lot of money.

Savings – $54,950.87

401k (Traditional)

$22,500.00

Emergency Fund

$5,000.00

Debt Repayment*

$12,784.87

Backdoor Roth Contribution

$6,000

Sinking Funds Contributions

$8,666.00

* I consider this “savings” insofar as it increases my net worth. Curious to hear if anyone disagrees with this approach, particularly as it comes to things like mortgages.

Annual Taxes – $54,564.00

Savings Rate – 37.85%

Net Worth – $94,960.06

I think I have a lot to be proud of. Over $50,000 saved in a year is nothing to sneeze at, nor is getting debt free. Hell, that’s approximately the median annual income for a full-time worker in the United States. "Table A-6. Earnings Summary Measures by Selected Characteristics: 2019 and 2020".

At the same time, I have some stuff to work on. Clearly, my spending is too high – somewhere close to $90,000 a year for just one person. Sure, I live in a high-cost-of-living area, but that’s insane.

Here are some areas I’m hoping to cut back on in the coming year:

Dining Out: Just from July through the end of 2022, $5,808.79 on dining out. Extrapolating, that’s $11,617.58 on eating out alone. Frankly, I’m horrified. I love dining out, and it brings me joy, but I don’t think I need to be spending quite that much, and I’d really like to get that number down. While I’d like to cut the number in half, I know starting small will be more sustainable for me in the long run, so my goal is to get the number down to $830ish a month, or $10,000 a year.

Medical: As I mentioned, I’ve been paying roughly $1,000 a month for psychotherapy. Because I’ve been doing a lot better, I think I’m going to cut back to every other week starting in May. That should hopefully help reduce annual expenses by a few thousand dollars.

Groceries: I spent around $6,000 on groceries last year, which breaks out to $500 a month on groceries. Because I want to decrease dining out and want to be sure I’m prioritizing spending on high-quality food, I don’t want to (yet) set a hard and fast number for decreasing grocery expenses. But I’ve been wasting a lot of food by way of throwing out leftovers and want to cut that out. To the extent reasonably possible, I’d like to move closer to buying and cooking only the food I’m actually going to eat. This will require better meal prepping, better use of my awesome chest freezer, and sucking up eating what’s on hand even if I might be “craving” something else.

What are your thoughts on my goals for the coming year? Anything else I should work on?